Calculate my 2024 tax refund

Tax refund is the amount of money you can expect to receive from the Internal Revenue Service (IRS) or your state tax authority after you file your return. Calculate my 2024 tax refund with the free online tax calculator provided by Turbotax to get your estimated tax refund or an idea of what you’ll owe. You’ll fill out basic personal and family information to determine your filing status and claim any dependents.

What is the tax refund estimator?

A tax refund estimator is a tool, often available online or through tax software, that provides an estimate of an individual’s potential tax refund or amount owed based on the financial information they input. It uses a calculation algorithm to simulate the tax return process, taking into account factors such as income, deductions, and credits. The results are instantaneous and serve as an educational tool to help individuals plan for their tax situation before filing an official tax return. However, the estimates are not guaranteed, and actual results may vary based on the completeness and accuracy of the information provided.

Tax Calculator

How to calculate my 2024 tax refund estimator?

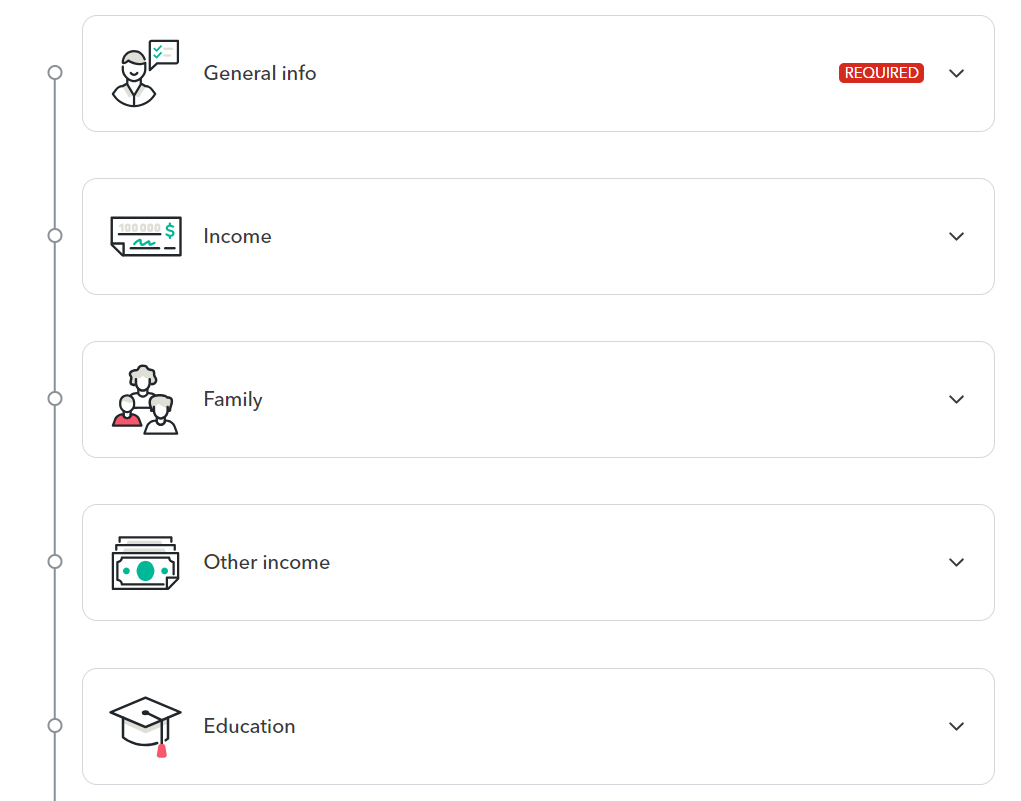

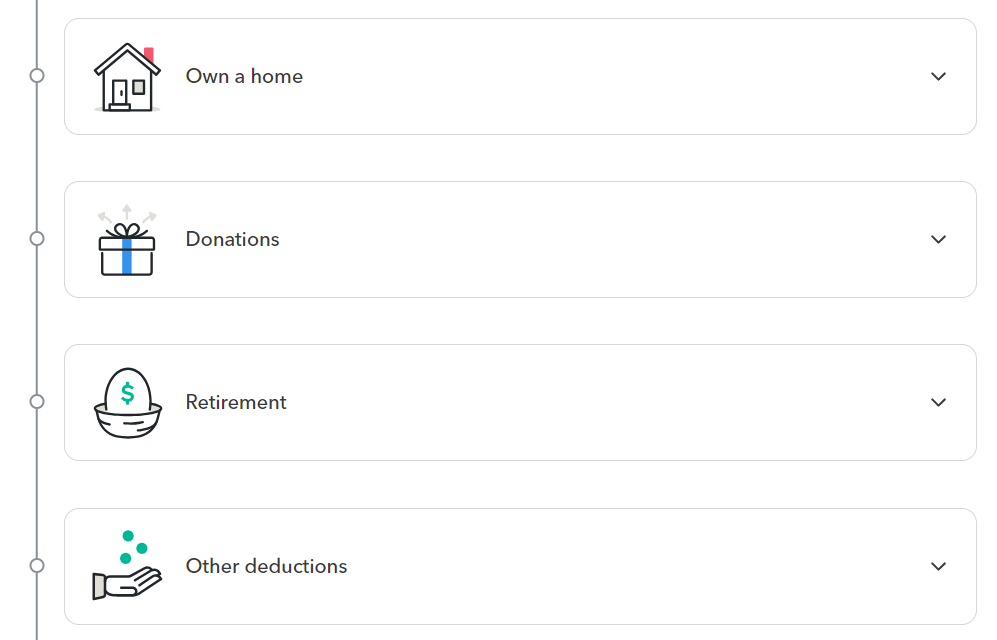

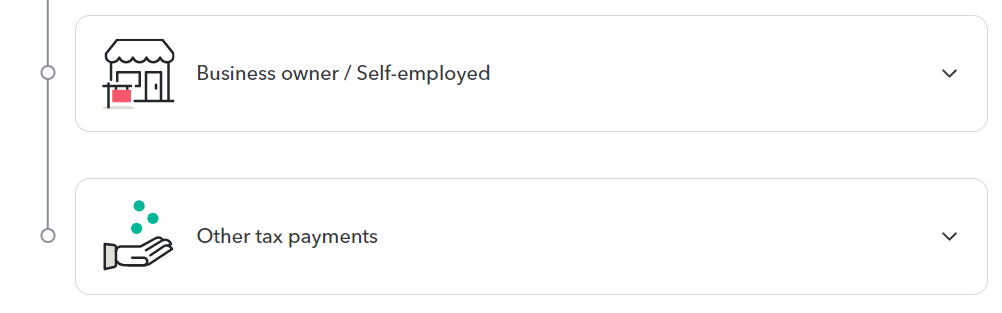

Turbotax usually provides a user-friendly interface to estimate your tax refund. Following are general steps you should follow to calculate tax refund:

- Open the turbotax website to “Calculate my 2024 tax refund“.

- Sign in with your turbotax account. If you don’t have a TurboTax account, create one.

- Begin a new tax return for the tax year 2024.

- Follow the on screen instructions provided by turbotax.

- Find the section Tax Calculators.

- Within the Tax Tools section, find the option for estimating your tax refund.

- Follow the prompts to input your financial details. It may include income, deductions, credits, and other relevant information.

- Now, Turbotax will provide an estimate of your potential tax refund.

- Save your estimated tax refund or else you can print the document if you want.

- Continue using Turbotax to complete and file your actual tax return.

How accurate is this estimate?

The data that you have provided to Turbotax is the foundation for the tax refund estimate. For ease of use, the estimator makes the following assumptions:

- The standard deduction will be applied.

- All income was taxed the same.

- If eligible, you claimed the Earned Income Tax Credit.

- If eligible, you claimed the Child Tax Credit.